Novated Leasing

What is a Novated Lease?

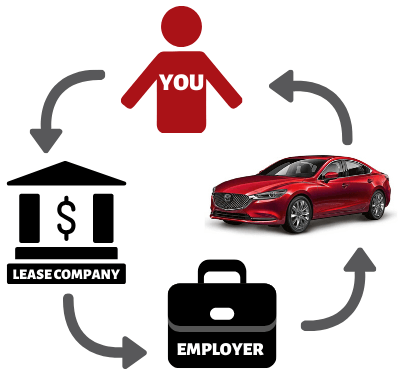

If you haven’t had a novated lease before it’s likely you have heard about them but never been quite sure what they are and how they work. Essentially a novated lease is a three-way car finance agreement between you, your employer and a leasing company. Depending on the type of Novated Lease, it can enable you to bundle all your car running costs into one regular ongoing tax effective payment and by doing so you can save money by reducing your taxable

income and pay less tax.

How does it work?

Traditionally, you earn a salary, pay income tax and then pay for all the costs of your car with the remaining money, also known as post-tax income. A novated lease can allow you to pay for all the

costs of your car with both pre and post-tax income.

This may include;

- Finance

- Fuel

- Servicing and maintenance

- Tyres

- Registration and CTP

- Comprehensive insurance

- Roadside assistance

- Car washing and detailing

If your employer offers Novated Leasing as a salary packaging option, you can select a vehicle that suits your lifestyle. You can choose the make and model, new or used, sedan, wagon, 4WD, etc., without any of the restrictions usually found with a traditional company fleet. You purchase the vehicle and then enter into a finance agreement in your own name.

Once you’ve purchased the vehicle, you, your employer and the finance company all sign a Novation Agreement. Your employer agrees to take on your obligations (repayments) to the finance company and is responsible for all of the agreed vehicle expenses which are deducted

from your remuneration as part of your salary packaging arrangement.

You agree to “salary sacrifice” a portion of your earnings in return for the benefit of a car equal to

that amount. With a Novated Lease, the lease, running costs of the vehicle and Fringe Benefits Tax (FBT) are deducted from your pre-tax earnings, and PAYG income tax is calculated on your reduced salary. This can effectively increase your net disposable income as you pay less tax.

It’s probably easier than you think

What are the benefits of a Novated Lease?

Novated Leasing can offer a range of benefits for both employees and employers.

Benefits for employees:

- A Novated Lease is both cost and tax effective. Your salary packaged vehicle costs are paid from your pre-tax income. Paying with pre-tax dollars means that you enjoy a lower rate of tax on the benefit than if you were to pay for the running costs of the vehicle using after tax income. You save money.

- Freedom to select the vehicle of your choice. This is because a salary packaged vehicle is not part of the company fleet.

- The vehicle is yours to use 100% of the time. The vehicle is yours and there are no restrictions on who can drive it.

- Your lease and your vehicle are portable. If you change jobs, you can take them both with you and enter into another Novation Agreement with your new employer and the financier.

- You benefit from any equity built up in the vehicle during the term of the lease. Any profit realised on the sale of the vehicle at the end of the lease is tax-free.

- Lease repayments are fixed for the term of the lease.

- You can select flexible lease terms from 12 to 60 months (one to five years).

- You can select flexible lease residuals, bearing in mind the Australian Tax Office (ATO) minimum residual guidelines for leases and the financier's maximum residual guidelines.

- Under a Novated Lease, the financier applies an Input Tax Credit (ITC) to remove the GST from the amount financed. This means that your repayments will be lower as you finance a reduced, GST-exclusive amount.

- Under a salary packaging arrangement all finance and operating costs for the vehicle are known as a "related benefit" and are GST and income tax-exempt.

Benefits for employers:

- The ability to provide more flexible remuneration to employees at little-or-no cost to your business.

- Significant savings of time and money compared to the administration of a company fleet.

- Elimination of the residual-value risk of a company fleet.

- The employer is not responsible for the vehicle if an employee leaves, and is not left with vehicles surplus to requirements.

- Vehicles provided under a Novated Lease are "off balance sheet" - neither an asset nor a liability.

- Reduced employee on-costs, such as Payroll Tax and WorkCover premiums.

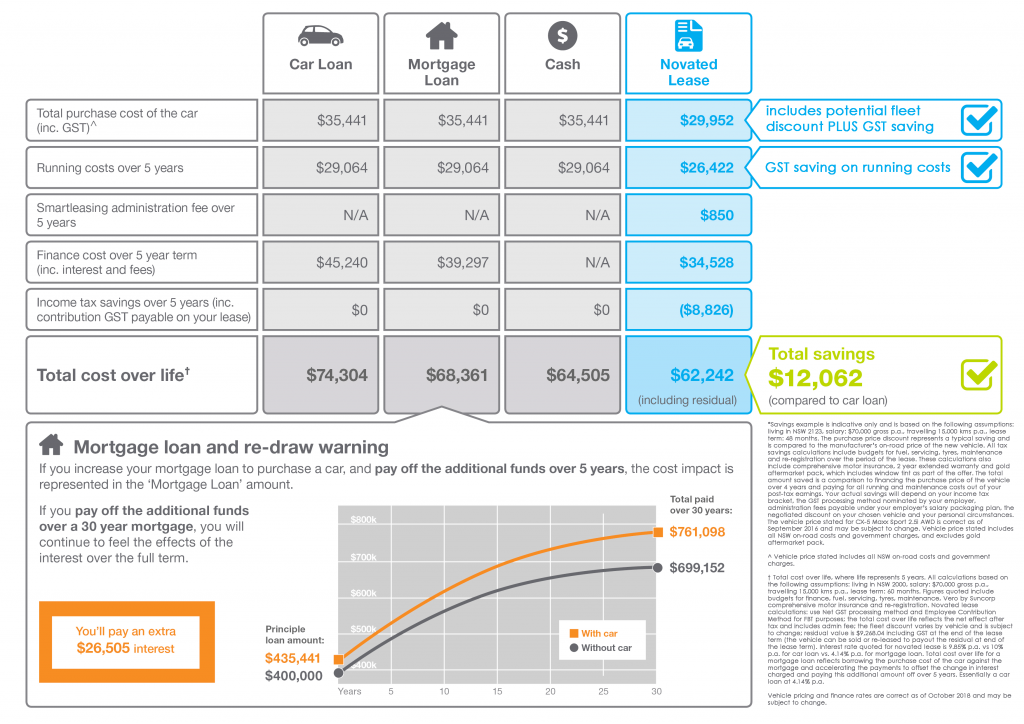

You can save money on the upfront car purchase and the ongoing running costs

Take a look at the below scenario to buy a brand new Mazda CX-5 Maxx Sport

Have a question about a Personal loan? Request a call-back

If you choose to provide your information, it will be used to offer or provide you with our services and/or the services of our associates. We may also ask you for feedback.

We may not be able to assist you if you do not provide your information. We may need to disclose your information to other organisations providing services to us that

may be overseas. If you would prefer not to receive marketing material you can always unsubscribe. We include a simple unsubscribe feature on all electronic marketing

materials that we send. Our Privacy Policy (which is available on this website) contains information about how you can access your personal information and request

corrections or lodge a complaint. Information about who we are and how to contact us is available on this website

Why use us for your Novated Lease?

When it comes to buying your house, a mortgage broker has long been the go-to

option for financing. Not only do they help you navigate the tricky world of home

loans, but they’re usually not aligned with any one lender, so they’ll take the time to

understand your finance situation and find a deal that aligns with your financial goals and situation.

So when it comes to other large investments such as your car, caravan or investing

to grow your business, it’s surprising that only 5% of the market use a broker. In fact,

most purchasers tend to stick to what they know or what they perceive to be easier,

their local bank or finance company.

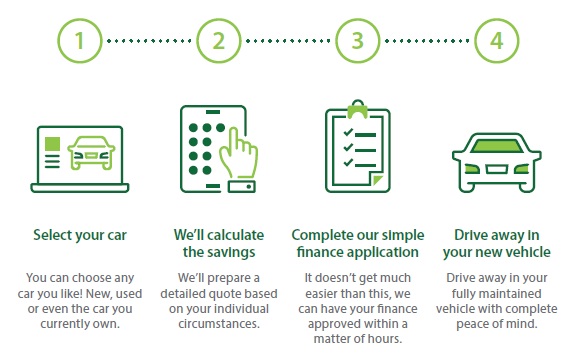

When it comes to securing a novated lease, the steps between finding a car,

understanding the pre-tax salary packaging and ensuring you’re getting a deal that’s

right for you can seem overwhelming. This is where we can help.

We take the time to understand how you intend to use your car, how long you might

want it for and more importantly, when it comes to novated, helping you understand the savings you can achieve. If you're considering a novated lease, here are the things you should expect from us as your experienced finance broker.

More about you

We are not aligned to any one lender, instead we work for you. It’s our job to

understand what you’d like to buy, your credit profile and history and what your long-

term goals are for your vehicle. Whether that be paying it off, trading it in or upgrading in the future. One of the benefits is that a credit check won’t be run on

your name until you give your permission to apply, so using us won’t affect your

credit score.

We will also ask you the right questions from the start and help you work out what might work best for you. Plus once active, if you have any problems with your loan

we will be able to assist.

More time to do other things

If you’re unsure about what you need to do or what paperwork you need to fill out, and you don’t have time to work it out, we can help you handle all the nitty gritty of the finance process.

As a novated lease is an agreement between three parties (the lender, the employer and yourself) and the paperwork involved can be more complex than your average

loan. We will be able to ensure your application is correct the first time and the

submission process can be done in one go, so you can spend less time worrying about it and more time looking for the right car!

All of the information provided on this page should be treated as a guide only and is general in nature and therefore should not be relied upon to make financial decisions.

We recommend speaking with your Accountant or Financial Planner to obtain professional advice that is specific to your circumstances.

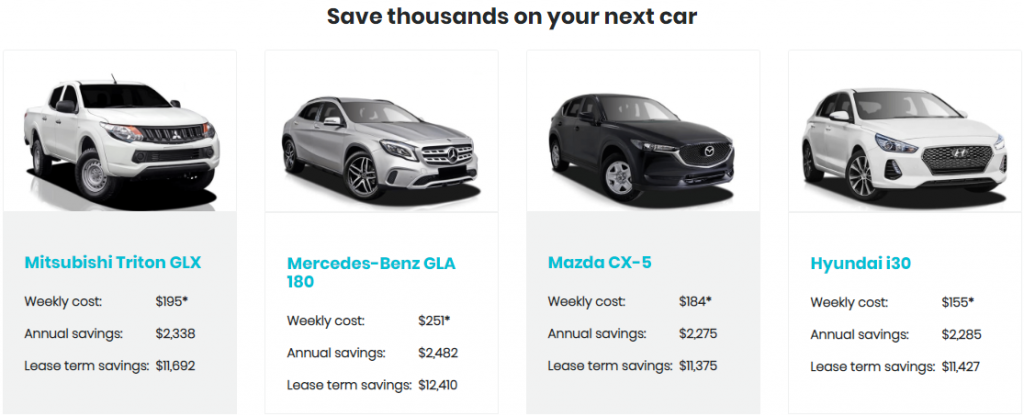

*The repayment estimates are provided by MYNEXTCAR Pty Ltd. Information is current as at 11 October 2018 and is subject to change. All calculations are based on a

60 months term, 15,000km per year, $80,000 annual salary, Victoria RRP drive away price as of 11/10/18 and standard ATO residual guidelines. All calculations shown

include a number of assumptions and are for illustration purposes only and serve as a guide only as to savings that you might achieve from salary packaging a vehicle via

a Fully Maintained Novated Lease. These calculations and illustrations do not represent or replace professional finance and tax advice. We accept no responsibility for

reliance on the calculations provided above.

The weekly repayment of $195 per week is for a new 2018 Mitsubishi Triton and is based on a driveaway price of $35,490. The weekly repayment of $251 per week is for

a new 2018 Mercedes-Benz and is based on a driveaway price of $49,777.50. The weekly repayment of $184 per week is for a new 2018 Mazda CX-5 and is based on a

driveaway price of $33,490. The weekly repayment of $155 per week is for a new 2018 Hyundai i30 and is based on a driveaway price of $24,990.